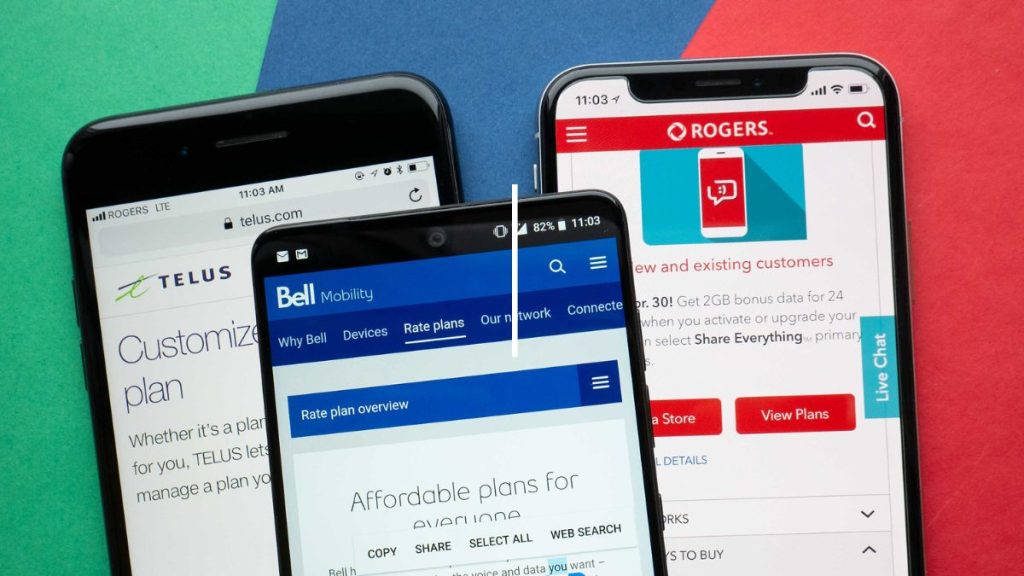

Guides to saving on your mobile and Internet plan

Ready to find your new plan? Use our free comparison tool for mobile and internet today!

Last articles

As Prime Day heats up on Amazon, another piece of tech news is electrifying enthusiasts: the Google Pixel 10 Pro Fold, the upcoming premium foldable smartphone from the Mountain View giant, has just been hit by two major leaks within days—revealing both its raw (...)

Are you looking for the cellular plan that’s right for you? Compare the best offers in a few clicks: it’s free.

A question ? An observation ? Explore different promotions, share your experiences with suppliers, and much more on the PlanHub forum.