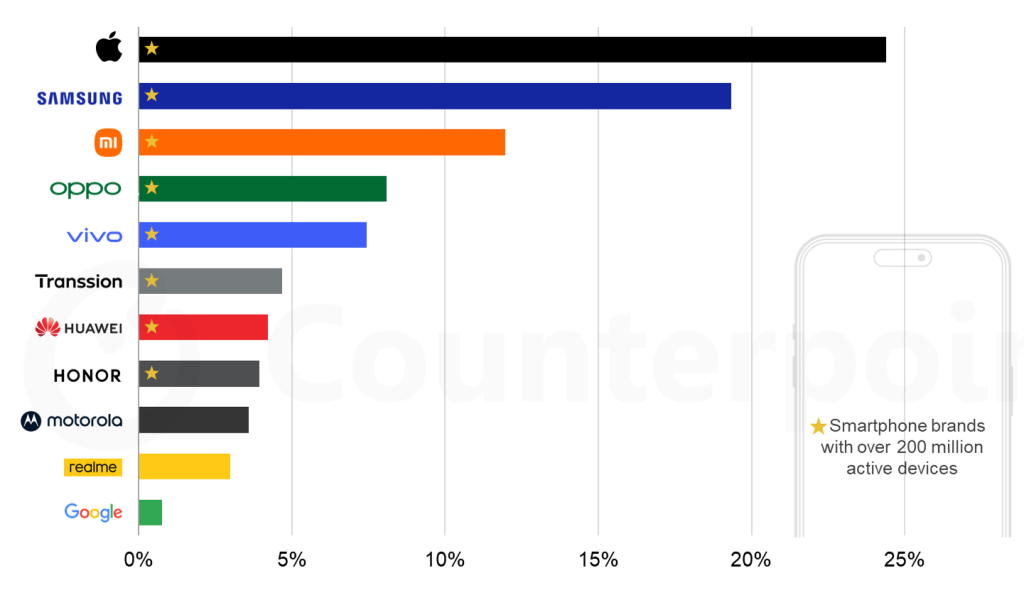

Counterpoint Research data suggests iPhone accounts for roughly a quarter of the global active smartphone installed base in 2025. It is a metric focused on devices actually in use, not just annual sales.

What “active installed base” really means

Installed base trackers estimate how many devices are currently being used, which helps capture retention, longevity, and ecosystem stickiness. Unlike yearly shipment numbers, it is a longer-term indicator of platform choice and device lifespan.

Apple near 25%, Samsung in second

According to Counterpoint, about one in four active smartphones in 2025 was an iPhone, while Samsung sits at roughly one-fifth. Together, Apple and Samsung account for 44% of the global active base, and they are the only two manufacturers to surpass one billion active devices.

Why the global base is growing slowly

The report points to longer replacement cycles, approaching four years, and a growing share of second-life devices staying in use. That combination slows annual growth, but makes resale value and long-term software support more important than ever.

The rest of the market is reshuffling

Behind the top two, Xiaomi, OPPO, and vivo remain major players across multiple price tiers, while Transsion continues to grow in regions like MEA and Southeast Asia. Counterpoint also notes milestones around the 200+ million active device mark, which signals meaningful scale for OEMs.

Details

| Brand | Recent phones / phones used in 2025 (examples) |

|---|---|

| Apple (iPhone) | iPhone 16 / 16 Plus, iPhone 16 Pro / Pro Max, iPhone 15 / 15 Pro, iPhone 16e (selon marché) |

| Samsung | Galaxy S25 / S25 Ultra, Galaxy S24 / S24 Ultra, Galaxy Z Fold6, Galaxy Z Flip6, Galaxy A55 / A35 |

| Xiaomi | Xiaomi 15 / 15 Ultra, Xiaomi 14 / 14 Ultra, Redmi Note 14 / Note 13, POCO F6 / X6 |

| OPPO | Find X8 / X7, Reno 12 / Reno 11, A Series récents (A79/A98 selon marché) |

| vivo | X200 / X100, V40 / V30, Y200 / Y100 |

| Transsion (TECNO / Infinix / itel) | TECNO Phantom V Fold / V Flip, TECNO Camon 30, Infinix Zero 30, Infinix Note 40, itel A/S series récents |

| Huawei | Pura 70 (série), Mate 60 (série), nova 12 (série) |

| HONOR | Magic7 / Magic6, HONOR 200 (série), X9b / X series récents |

| motorola | Razr 50 / Razr+ (Ultra), Edge 50 (série), Moto G (2025 / 2024 variants) |

| realme | realme GT 6, realme 12 / 12 Pro (série), realme C (série 2025) |

| Google (Pixel) | Pixel 9 / 9 Pro, Pixel 8 / 8 Pro, Pixel 8a, Pixel Fold |